Watch this Quick Explainer Video

Almost everyone with schedule C income qualifies.

-

Sole Proprietors

-

1099 Contractors

-

Freelancers

-

Single-member LLC's

-

Gig Workers

-

Other Self-Employed Workers

What is SETC?

Self-Employed Tax Credit Under the American Rescue Plan Act

The SETC is a specialized tax credit designed to provide support to self-employed individuals during the COVID-19 pandemic.

It acknowledges the unique challenges faced by those who work for themselves, especially during times of illness, caregiving responsibilities, quarantine, and related circumstances. This credit can be a valuable resource for eligible individuals to help bridge financial gaps caused by unforeseen disruptions.

Almost everybody with schedule C income qualifies.

Amidst the pandemic, millions grappled with COVID-related challenges, including:

- Illness

- Symptoms

- Quarantine

- Testing

- Caregiving

- Financial Relief

If you found yourself in such situations, where COVID impacted your ability to work, the SETC was designed to be your safety net, but it's not too late.

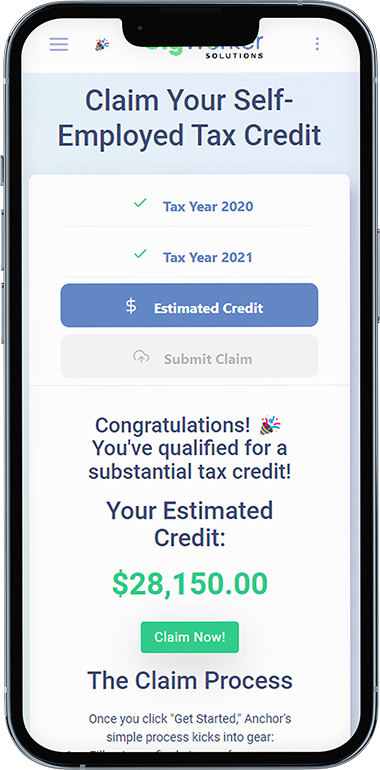

How much can I qualify for?

You may be eligible for up to $32,220 in tax credits from 2020 & 2021

Self-Employed Status:

If you were self-employed in 2020 and/or 2021, you could potentially qualify for the SETC. This includes sole proprietors who run businesses with employees, 1099 subcontractors, and single-member LLCs. If you filed a “Schedule C” on your federal tax returns for 2020 and/or 2021, you're on the right track. COVID Impacts:

COVID Impacts:

Whether you battled COVID, experienced COVID-like symptoms, needed to quarantine, underwent testing, or cared for a family member affected by the virus, the SETC could be your financial relief. If the closure of your child's school or daycare due to COVID restrictions forced you to stay home and impacted your work, we're here to help.

What our customers are saying

We've helped thousands of hard-working American's get their Self-Employed Tax Credit

Frequently Asked Questions

The SETC is a specialized tax credit designed to provide support to self-employed individuals during the COVID-19 pandemic.

It acknowledges the unique challenges faced by those who work for themselves, especially during times of illness, caregiving responsibilities, quarantine, and related circumstances. This credit can be a valuable resource for eligible individuals to help bridge financial gaps caused by unforeseen disruptions.

Almost everybody with schedule C income qualifies.

- Sole Proprietors

- 1099 Contractors

- Freelancers

- Single-member LLC's

- Gig Workers

- Other Self-Employed Workers

We make the process simple and easy. If you have your Tax returns you can complete the process in under just 20 minutes. First, create your free account in our secure client portal. Next, you provide some information so that we can calculate an estimate of your credit. Lastly, you upload your tax returns through our secure upload and we handle the rest!

Don't Wait! There's a deadline to file your claim.

Take advantage of the SETC Tax Credit designed for self-employed individuals just like you!

Our Team Experts

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Laborum obcaecati dignissimos quae quo ad iste ipsum officiis deleniti asperiores sit.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Laborum obcaecati.